Sales is not the problem when your sales cycle gets longer

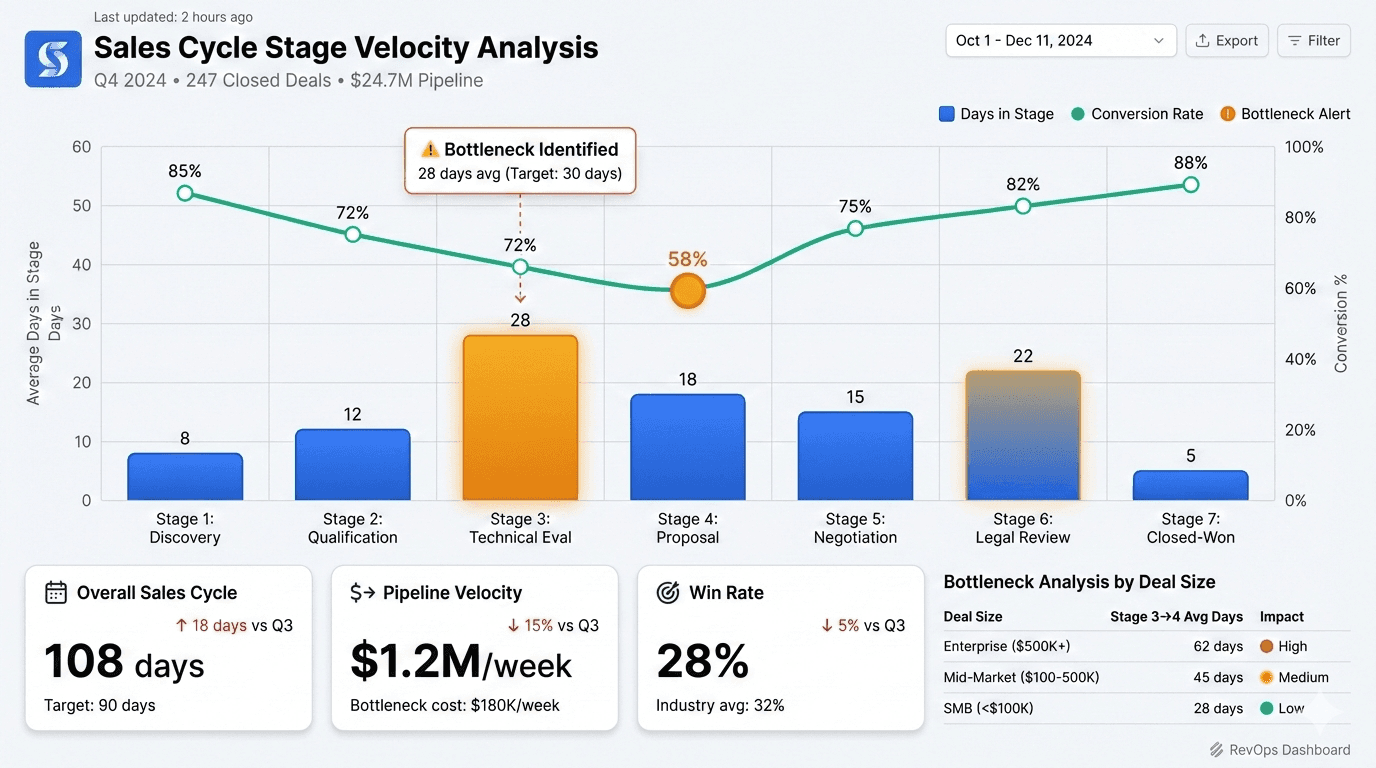

Your Stage 3→4 is taking 47 days instead of 30.

Your VP Sales blames rep productivity. Your CRO blames deal quality. Your CEO blames the economy.

They're all wrong.

Here's why: Academic research identified 18 strategic levers that drive revenue growth in B2B companies. Things like brand perception, customer experience quality, how fast data moves between teams, digital channel effectiveness, product innovation signals, and yes—sales execution.

Sales controls fewer than 5 of these 18 levers.

Marketing owns maybe 4. Customer Success another 3. Product, IT, Finance, Legal—they all control pieces.

No single function owns more than 25% of what drives growth.

So when Stage 3→4 takes 47 days instead of 30, the bottleneck usually isn't in sales at all. The real problems hide in cross-functional handoffs that nobody's measuring.

When we analyze where deals actually slow down, here's what we find:

Marketing qualified to a lower threshold - They're hitting their MQL targets, but pushing friction downstream to sales. The "qualified" leads aren't actually ready.

Product trials aren't activating fast enough - Without product urgency, prospects have no reason to move forward. The 14-day trial becomes a 45-day evaluation.

Legal review is the actual bottleneck - Contracts aren't templatized. Every deal requires custom review. Legal has a 2-week SLA that nobody tracks.

Finance is slowing approvals - Deal structure doesn't fit their process. Non-standard payment terms require executive approval. Three-way matching delays PO processing.

Customer Success isn't feeding expansion signals back - CS sees buying intent in product usage data, but there's no systematic handoff to sales. Opportunities age in Stage 2 waiting for "the right time."

This is why measuring stage velocity as just a "sales metric" misses the entire point.

Most companies measure their sales cycle: the time from first touch to close.

But what actually determines velocity is your revenue cycle: the integrated system spanning awareness, demand, purchase, and consumption.

When you only instrument the sales portion, you're measuring 25% of the system and wondering why you can't fix the other 75%.

The Four Stages of the Revenue Cycle

Awareness - Controlled by Marketing, Product Marketing, Brand

- Levers: Brand perception, content quality, channel effectiveness

- Bottleneck signs: Low inbound volume, wrong-fit leads, cold outbound required

Demand - Shared by Marketing and Sales

- Levers: Lead qualification, nurture effectiveness, SDR productivity

- Bottleneck signs: Low MQL→SQL conversion, long qualification times, high early-stage churn

Purchase - Shared by Sales, Legal, Finance, Security

- Levers: Sales execution, deal structure, approval processes, contract velocity

- Bottleneck signs: This is where you're measuring stage velocity today

Consumption - Controlled by CS, Product, Support

- Levers: Onboarding speed, time-to-value, adoption rates, expansion signals

- Bottleneck signs: Low NRR, churn, missed expansion revenue

When Stage 3→4 slows down, the root cause could be in ANY of these four phases.

Step One: Map Stage Velocity to Your Commercial Architecture

Stop measuring time-in-stage across all deals. That's like calculating average temperature across all climates—technically accurate, meaningless for decision-making.

Instead, segment by what actually matters:

High-volume, low-ACV deals with Stage 2→3 delays = Automation gap

- Root cause: Manual qualification at scale

- Owner: Marketing Ops + Sales Ops

- Fix: Implement automated lead scoring, route-to-rep automation, or self-service buying

Enterprise deals with Stage 4→5 friction = Legal/security process issue

- Root cause: Custom contract review, security questionnaires, compliance requirements

- Owner: Legal + Security + Sales

- Fix: Templatize contracts, pre-approve standard terms, create security documentation library

Expansion deals stalling in Stage 2 = CS-to-Sales handoff problem

- Root cause: No systematic process for CS to flag buying intent

- Owner: Customer Success + Sales

- Fix: Implement product usage scoring, create expansion playbook, define handoff triggers

Same symptom. Completely different root causes. Different owners.

Step Two: Layer in Revenue Intelligence

Measuring time alone is incomplete. You need to measure stage velocity BY the economics of the deal.

Measure stage velocity BY deal size:

30 days in Stage 3 for a $10K deal = Broken process (should be less than 10 days) 30 days in Stage 3 for $500K deal = Perfectly acceptable (complex buying committee)

Measure stage velocity BY margin profile:

Where should you pay for speed? High-margin deals justify expensive interventions (dedicated SE, executive sponsors, custom demos). Low-margin deals require efficient, scalable motions.

Measure stage velocity BY expansion potential:

A 60-day Stage 3 on a $1M enterprise deal with 300% NRR potential? That might be exactly right—you're building a relationship that will compound.

A 60-day Stage 3 on a $25K transactional deal with 100% NRR? That's broken architecture.

The companies that scale don't optimize for speed everywhere. They optimize for economic efficiency: fast where margin allows, strategic where lifetime value demands it.

Step Three: Treat Stage Velocity Data as the Strategic Asset It Is

Your stage progression data doesn't appear on your balance sheet. But it's one of your most valuable assets.

Here's proof: When United Airlines needed emergency financing during the pandemic, they collateralized their MileagePlus loyalty program. Third-party appraisers valued it at $20 billion—more than double United's market cap at the time.

Why? Because the data predicted future customer behavior and revenue.

Your stage velocity data does the same thing. It's your roadmap to:

- Which behaviors predict revenue

- Which handoffs break down

- Where capital allocation creates competitive advantage

- What deal profiles are actually profitable

Most companies measure it. RevOps monetizes it.

Here's how:

Build predictive models - Which Stage 1 behaviors predict Stage 5 close? What's the correlation between trial activation speed and win rate? Use this to prioritize resources.

Quantify handoff costs - When Marketing→Sales handoff takes 5 days instead of 1 day, what's the impact on win rate? On deal size? This builds the business case for fixing it.

Segment by profitability - Not all revenue is equal. Which deal profiles have the best combination of high velocity + high margin + high retention? Double down there.

Create stage architecture - Map out where technology drives efficiency vs. where human expertise drives value. This becomes your capital allocation framework.

Here's how to actually do this in your business:

Phase One: Audit Your Current State (Week 1-2)

Map your stages to functions:

- Create a spreadsheet with sales stages down the left

- List all functions across the top (Sales, Marketing, CS, Legal, Finance, Product, IT)

- For each stage, identify which functions control velocity

- You'll quickly see that "sales stages" involve 6+ departments

Pull the data:

- Export all closed-won deals from the past 12 months

- Calculate time-in-stage for each deal

- Segment by deal size, industry, product line

- Identify outliers (deals that moved exceptionally fast or slow)

Interview the operators:

- Talk to reps about where deals stall and why

- Talk to CS about what they see in expansion deals

- Talk to legal about their actual process time

- Document every handoff and who owns what

Phase Two: Diagnose Root Causes (Week 3-4)

For each stage with velocity issues, ask:

Is this a volume problem? (Too many deals for available resources) Is this a quality problem? (Wrong deals entering this stage) Is this a process problem? (Handoffs, approvals, missing information) Is this a capability problem? (Team lacks skills or tools) Is this a structure problem? (Incentives misaligned, unclear ownership)

Run the cross-functional workshop:

- Bring together Sales, Marketing, CS, Legal, Finance

- Walk through your stage velocity data

- For each bottleneck, identify the actual owner

- Get commitment on fixes

Most "sales problems" turn out to have owners outside sales.

Phase Three: Implement Quick Wins (Week 5-8)

Start with changes that don't require executive approval or budget:

Templatize what's custom - Legal contracts, security questionnaires, ROI calculators Automate what's manual - Lead routing, meeting scheduling, quote generation Systematize what's ad hoc - CS expansion handoffs, competitive intelligence, demo environments Clarify what's ambiguous - Stage definitions, exit criteria, handoff procedures

Track everything. Measure before/after for each change.

Phase Four: Build the Business Case (Week 9-12)

Now you have data. Use it to get budget for bigger fixes:

Calculate the revenue impact:

- If you reduce Stage 3→4 by 10 days, and you have 200 deals/year at $100K average...

- That's 5,479 person-days saved annually

- At 250 working days/year, that's 22 full-time equivalents worth of capacity

- You just "hired" 22 people without hiring anyone

Quantify the capital allocation:

- You're spending $X on sales headcount

- But only 25% of velocity is controlled by sales

- That means $0.75X is being spent on problems sales can't solve

- Reallocate some of that to the actual bottlenecks

Show the competitive moat:

- Companies that fix cross-functional velocity create sustainable advantages

- It's easy to copy a sales play

- It's nearly impossible to copy an integrated revenue cycle

Sometimes stage velocity problems aren't fixable within your current architecture. You need to rebuild the stages themselves.

Signs you need to rebuild:

Your stages map to your internal process, not the buyer's journey You have different stage definitions for different products/segments Reps spend more time updating CRM than advancing deals Your forecast accuracy is below 80% Win rates vary wildly across reps despite similar territories

How to rebuild:

Start with the customer's buying process, not your selling process Define stages by buyer commitment level, not seller activities Create clear, observable exit criteria for each stage Align stages across the entire revenue cycle (marketing, sales, CS) Build in the cross-functional handoffs explicitly

This is a 6-12 month project. Don't start unless you have executive sponsorship.

Pitfall One: Optimizing for speed everywhere

Not all deals should move fast. Enterprise deals with high LTV need time to build relationships. Don't sacrifice strategic selling for velocity metrics.

Pitfall Two: Measuring without acting

Stage velocity data is useless if you don't change anything. The measurement is just the diagnostic—you still need to implement fixes.

Pitfall Three: Making it a sales project

If Sales owns this initiative, it will fail. This is a revenue cycle project requiring cross-functional ownership. RevOps should lead.

Pitfall Four: Ignoring the post-sale

Most companies stop measuring at "Closed-Won." But onboarding velocity, time-to-value, and expansion cycle time are just as important for revenue growth.

Pitfall Five: Forgetting the why

Stage velocity is not the goal. Revenue growth is the goal. Sometimes the highest-velocity motion is not the highest-revenue motion.

When your sales cycle gets longer, the instinct is to blame sales.

But sales controls less than 25% of what determines velocity.

The real bottlenecks hide in cross-functional handoffs:

- Marketing to Sales

- Sales to Legal

- Legal to Finance

- CS to Sales

- Product to all of the above

The companies that scale don't just measure these bottlenecks.

They architect around them.

They build stage definitions that span functions. They instrument handoffs as first-class metrics. They segment by economics, not just time. They treat their velocity data as a strategic asset.

Because sales cycles aren't getting longer.

Revenue cycles are getting more complex.

And the companies that architect for that complexity—instead of just measuring it—are the ones that scale.

Ready to diagnose your stage velocity issues?

Start here:

- Pull your deal data from the past 12 months

- Calculate time-in-stage by deal size

- Identify your biggest outliers

- Interview 5 reps about where deals stall and why

- Map which functions actually control velocity at each stage

You'll quickly see: your "sales problem" probably isn't a sales problem at all.

What's holding up YOUR Stage 3→4? Is it actually a sales problem, or is it hiding in a cross-functional handoff nobody's measuring?